What is a Portfolio?

A portfolio is a collection of various financial assets, such as stocks, cash, mutual funds (MFs), bonds, ETFs (Exchange-Traded Funds), commodities, and other types of financial instruments.

What is Portfolio Management?

Portfolio management is the process of managing a set of activities, including the analysis and allocation of financial assets, portfolio evaluation, rebalancing, and monitoring. This is done in accordance with an investor's Investment Policy Statement (IPS). It also involves measuring and reporting portfolio performance to ensure transparency and maintain investor satisfaction and trust.

The Portfolio Approach to Investing

Within portfolio management, we consider several fundamental approaches to investing, such as diversification, risk minimization, composition rules, and downside protection. Let's discuss each approach individually.

- Portfolio Diversification: The benefits of a diversified portfolio are best summarized by the well-known adage: "Don't put all your eggs in one basket." This principle is frequently cited by many successful investors and portfolio managers, including Mr. Warren Buffett.

- Reducing Risk: Typically, a diversified portfolio exhibits lower overall risk or volatility (measured by standard deviation) than any single financial security or asset. Within a diversified portfolio, individual securities show correlations with one another. For example, Security A might rise 1.5 times more than the market, while Security B within the same portfolio might only decrease by 0.3 relative to the market. These correlations help stabilize the portfolio.

- Composition Matters: A portfolio is a collection of securities in various proportions. Each individual security has its own historical risk-return profile based on past market prices. By allocating different percentages to different securities, we can construct a portfolio with an optimized risk-return profile (aiming for maximum profit at minimum risk).

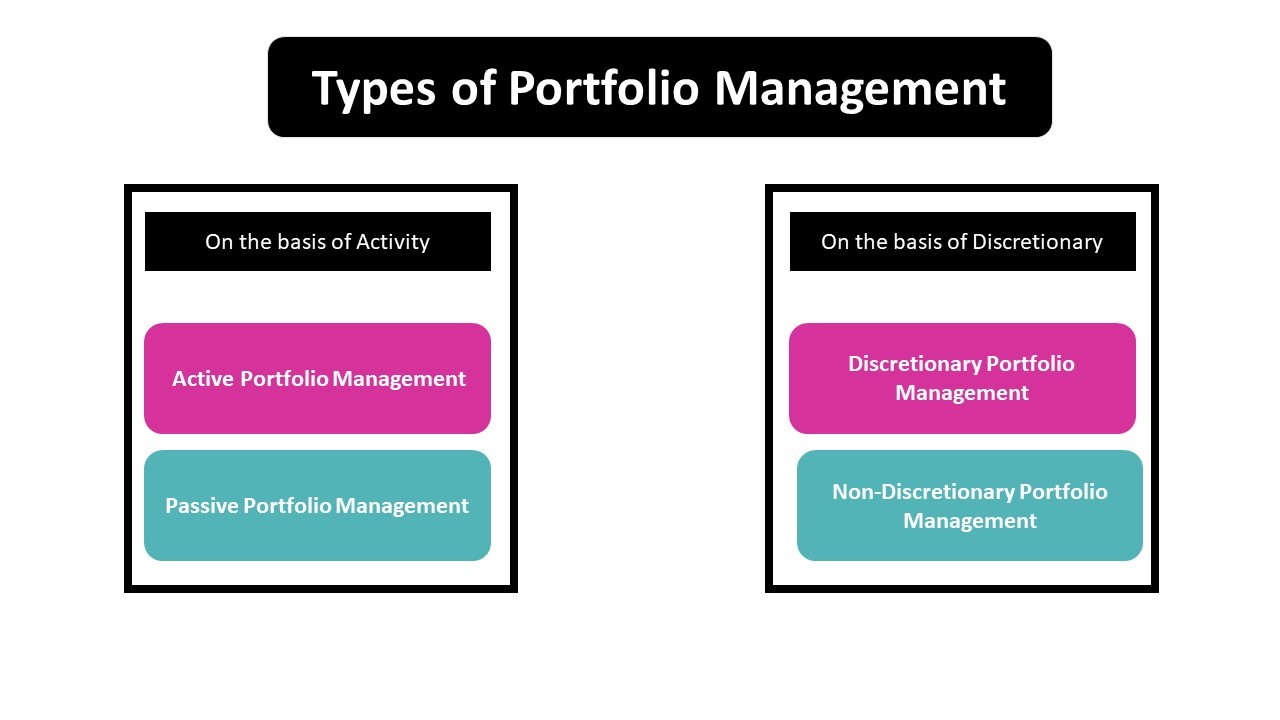

Types of Portfolio Management

On the Basis of Activity

- Active Portfolio Management: This is a type of portfolio management where Portfolio Managers (PMs) actively buy and sell assets frequently in an effort to outperform a specific benchmark or index. They typically charge a percentage fee based on the Assets Under Management (AUM).

- Passive Portfolio Management: In passive management, managers follow a strategy that aims to mimic broader market indices. PMs allocate securities in a composition that tracks an index, making it easier to monitor the investor's portfolio performance relative to the market.

On the Basis of Discretion

- Discretionary Portfolio Management: In discretionary management, the full responsibility for the investor's capital is given to the Portfolio Manager. The manager makes investment or speculative decisions based on their own professional perspective.

- Non-Discretionary Portfolio Management: In non-discretionary management, the financial advisor provides recommendations, but the final decision-making power remains with the investor. In this case, the PM's role is more advisory than executive.

The Portfolio Management Process

- Investment Policy Building and Asset Allocation

- Investment Vehicle Analysis and Evaluation

- Diversified Portfolio Construction

- Portfolio Reconfirmation

- Portfolio Monitoring and Rebalancing

- Performance Measurement and Reporting

Investment Policy Building and Asset Allocation

This is the initial stage of portfolio management, which can be split into two main tasks:

- Investment Policy Statement (IPS): The IPS is a document that outlines several components, including investment objectives, constraints (Time Horizon, Tax Concerns, Liquidity Requirements, Legal/Regulatory factors, and Unique Circumstances), procedures, risk-return objectives, and risk tolerance.

- Asset Allocation: This is the process of allocating different securities in specific proportions based on capital market expectations, risk and return profiles, and the objectives and constraints defined in the IPS. Assets may include stocks, bonds, commodities, ETFs, real estate, and other securities.

Investment Vehicle Analysis and Evaluation

We select investment vehicles that offer the best balance of diversification at a low cost. The four main types of investment vehicles include:

- Stocks

- Bonds

- Real Estate

- Cash

Among these, individual stocks, bonds, mutual funds, ETFs, and index funds are the most common. Each type of security requires specific analysis techniques. For example, stocks are evaluated using Fundamental and Technical Analysis, while bonds and fixed-income securities are analyzed based on credit ratings, Yield to Maturity (YTM), and other financial mathematics.

Diversified Portfolio Construction

Next, the Portfolio Manager constructs the portfolio using concepts from Modern Portfolio Theory (MPT).

- MPT helps investors create a portfolio that minimizes risk for a given level of expected return.

- Using MPT, risk-averse investors can construct portfolios that maximize expected returns based on a specific level of market risk.

- MPT utilizes diversification techniques across various investment vehicles with different risk-return profiles and correlations. This may include stocks from different industries, corporate or government bonds, and various ETFs or mutual funds.

Portfolio Reconfirmation

After building a diversified portfolio based on the IPS, the Portfolio Manager presents it to the investor. The investor then provides permission to proceed or requests adjustments if certain aspects of the portfolio do not meet their requirements.

Portfolio Monitoring and Rebalancing

The Portfolio Manager executes the investments and continuously monitors the included assets. If the portfolio deviates from the risk-return parameters defined in the IPS, the manager performs rebalancing to bring it back in line.

Performance Measurement and Reporting

Finally, the Portfolio Manager measures the portfolio's performance and provides detailed reports to the investor to track progress against goals.

Powered by Froala Editor