What is a Business Cycle?

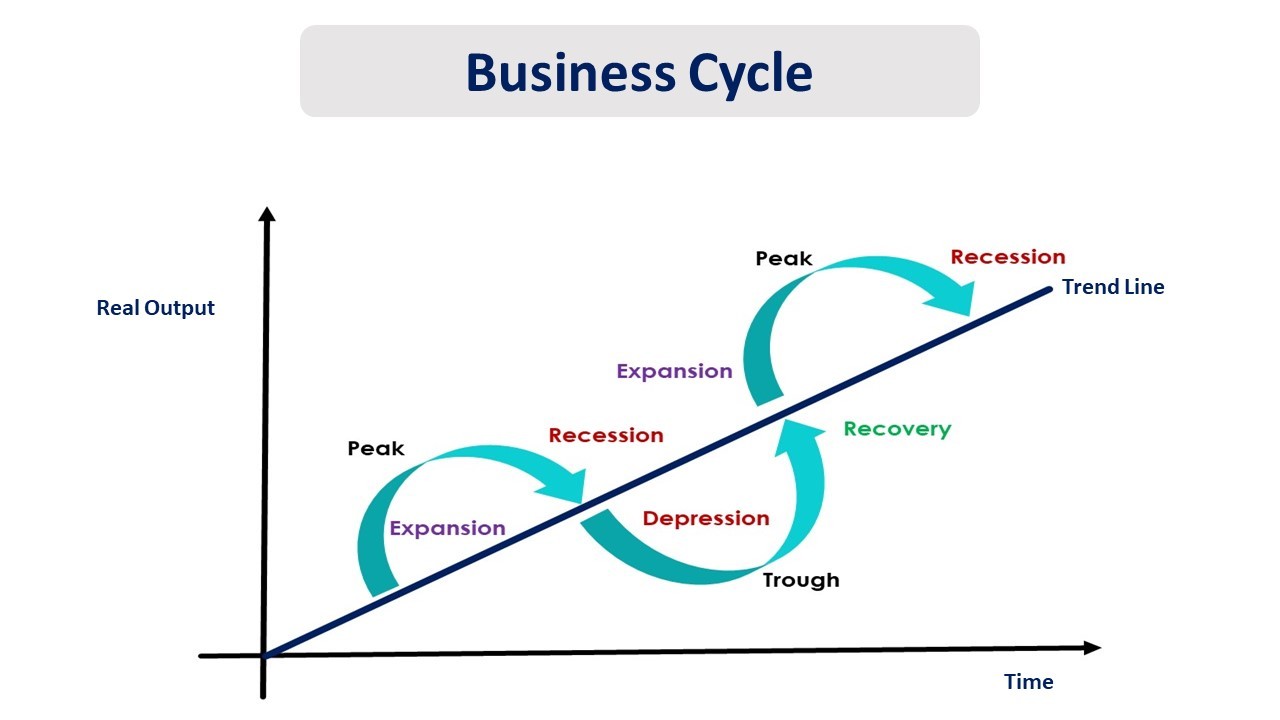

A business cycle is the cycle of fluctuations in Gross Domestic Product (GDP) around its long-term natural growth rate. Also known as a trade cycle or economic cycle, it describes the expansion and contraction of economic activities that a country experiences over time.

A business cycle is considered complete when it passes through a boom and a fall in a specific sequence. The time interval in which a business cycle completes itself is referred to as the "length" of the business cycle. A boom or expansion represents a period of rapid economic growth. Conversely, the period in which economic growth decreases following an expansion is a recession. These various phases are measured in terms of real GDP growth, which is adjusted for inflation.

Phases in a Business Cycle

- Expansion: In the initial stage of a business cycle, an expansion occurs, characterized by an increase in real output and other positive economic indicators such as employment, profits, wages, and the demand and supply of goods and services. For this article, we assume Real GDP as the default measure of real output. During this phase, investment levels are high due to investor optimism. Businesses operate profitably, and consumers purchase goods and services at a higher rate. Debtors are generally able to repay loans on time due to steady income. This process continues until economic indicators reach their upper limit.

- Peak: As with any system, an economy has a limit to its potential and efficiency. Eventually, the expansion phase reaches a point where real output hits its maximum, or "saturation point." At this stage, economic indicators cannot grow further, and prices reach their highest levels. This point signals that the economic trend is about to reverse as the market begins to restructure.

- Recession: The recession phase follows the peak. During this time, consumer demand begins to decrease. Often, producers continue to manufacture goods without realizing that demand has shifted, leading to an oversupply. Due to lower demand and excess supply, the prices of goods decrease, eventually leading to business losses. If this decline continues for at least six months or two consecutive financial quarters, it is officially classified as a recession.

- Depression: If the downturn persists, economic growth continues to fall due to decreased tax collection and widespread business losses. As companies struggle, the unemployment rate rises sharply. This results in a steady, long-term decline in the economic growth rate, a phase known as a depression.

- Trough: During a depression, the economic growth rate may become negative. This phase continues until the prices of factors, as well as the demand and supply of goods, contract to their lowest points. This lowest point is called the "trough." It can be understood as a negative saturation point and is the exact opposite of the peak.

- Recovery/Revival: Eventually, the economy enters a recovery stage, and the magnitude of negative growth begins to reduce. Consumer demand starts to rise again due to lower prices, leading to a subsequent increase in supply from producers. Investors regain their optimism and begin reinvesting. This process continues until the economic growth rate returns to steady levels. Employment increases to meet new demand, and central authorities often launch fiscal and monetary policies to further boost the economy.

Effects of the Business Cycle

During Expansion: The expansion phase is a developing period that fosters positive economic indicators and minimizes negative ones.

High Growth: High growth leads to the following factors:

- Increased large-scale investments

- Growth in employment

- Rise in both income and expenditure

Inflation: As investment drives the expansion, the money supply in the economy increases. Higher demand for inputs and factors of production drives up the price of goods, resulting in an increased inflation rate.

Severe Competition: With many firms increasing production, competition for market share becomes intense, often leading to high expenditures on marketing and advertising.

During Recession: The recession phase is a negative period in the cycle, though generally less severe than a depression. It is marked by a decline in positive indicators and a rise in negative ones.

- Excess Inventory: Businesses that manufactured or purchased excess stock during the expansion phase now face the burden of maintaining unsold items.

- Unemployment: As demand falls, supply is reduced. Due to mounting losses, firms are often forced to lay off employees or are unable to hire new staff, leading to a higher unemployment rate across the economy.

Powered by Froala Editor