Understanding the preparation of financial statements is one of the important reasons for your business success because these statements reflect the business financial performance and the financial health of the company.

Unfortunately, there are huge amount of business owners who fail in running their business because of lack of financial knowledge as well as the failure to understand preparation and analyzing their financial statements.

Let us understand how to prepare various financial statements in detail.

Analyzing and understanding of various financial statements

If you want to report the financial information to your users or within the organization about the company’s performance, financial statements are the main way to report it to the people.

Investors will look upon the financial statements and analyze it before investing in our company.

For instance, a small start-up company suddenly grew up for the three consecutive years with a huge profit but then it failed. What is the reason behind their failure? It may be because they overspent on assets or by offering credit terms and discounts to customers.

There are basically three financial statements such as Profit and Loss (income statement), the balance sheet, and the statement of cash flows.

Profit and Loss statement:

Also known as income statement is a summary of the revenue and the expenses of a company for a particular period say one financial year.

Balance sheet:

It is a list of all the assets and liabilities, usually tallied at the end of the financial year.

Cash flow statements:

It is a summary of all the cash receipts and payments for a specific period of time say one financial year.

If we talk about a small business or a mid sized company, these financial statements are constant and mandatorily prepared at the end of the financial year or any other closing year as per followed by the company.

Understanding and knowing the financial statements is not a rocket science. Since most of the business entrepreneurs have basic financial knowledge, so analyzing the company’s financial performance must be easy for them.

Let us dive into the preparation of various financial statements in detail:

Income statement:

When you are running a business even if it is a very small start-up, it is crucial to understand the profitability of the business. If you ignore the income statement, you won’t have any idea of what is the current position of your business or you are probably overlooking the opportunities to expand your business.

What is an income or profit and loss statement?

It is basically a summary of all the revenues and expenses of the business over a selected period of time.

If we talk about the simple mathematical calculation

Income= Revenue – Expenses

Loss= Expenses – Revenue

Why we use Income statement?

The very first purpose of preparing Income statement is to know about the profitability of the business over a particular accounting period. If the business has been carried over for several years, one can evaluate the previous years performance with that of the current year.

It is also useful for tracking the revenues and expenses to plan the annual budgets and sales projections. It can be used for estimating the tax liability of the business.

What is the format for preparing an Income statement?

Preparation of an income statement is not that difficult for a professional accountant. The format will generally be same as per the given standards. However, it may vary slightly as per the company.

Let us see in detail what is included in the profit and loss statement with the meaning.

Total revenues (gross sales)

It is the revenue amount generated by the business.

Less: sales returns and allowances

It is an amount representing goods return or sales discount

Net Revenues (Sales):

It includes total sales minus sales returns

Cost of Goods sold or cost of sales:

It represents the cost directly associated with acquiring your products or goods.

Gross Profit:

Also called as Gross Margin is determined by subtracting the total cost of goods from net sales. However, it excludes any operating expenses or income taxes.

Operating expenses:

Any daily or administrative expenses incurred in the business operation, such as advertising, interest expenses, rent expenses; depreciation, etc. are listed in operating expenses. The order may vary as per the company standards.

Total expenses:

Sum of all operating expenses and non-operating expenses such as taxes are known as total expenses.

Net operating income or Net Profit:

It is the amount incurred or earned by a business before paying income taxes.

Non-operating income:

Gain or loss in the short and long-term assets or interest income is included in the non-operating income.

Taxes:

Taxes are the amount that a business owes to the federal, state, or local government.

Net Income (profit):

The amount earned after deducting all the expenses for a particular year. If the income is more it is profit for the year, but if the income is less than expenses, you are suffering from loss in that year.

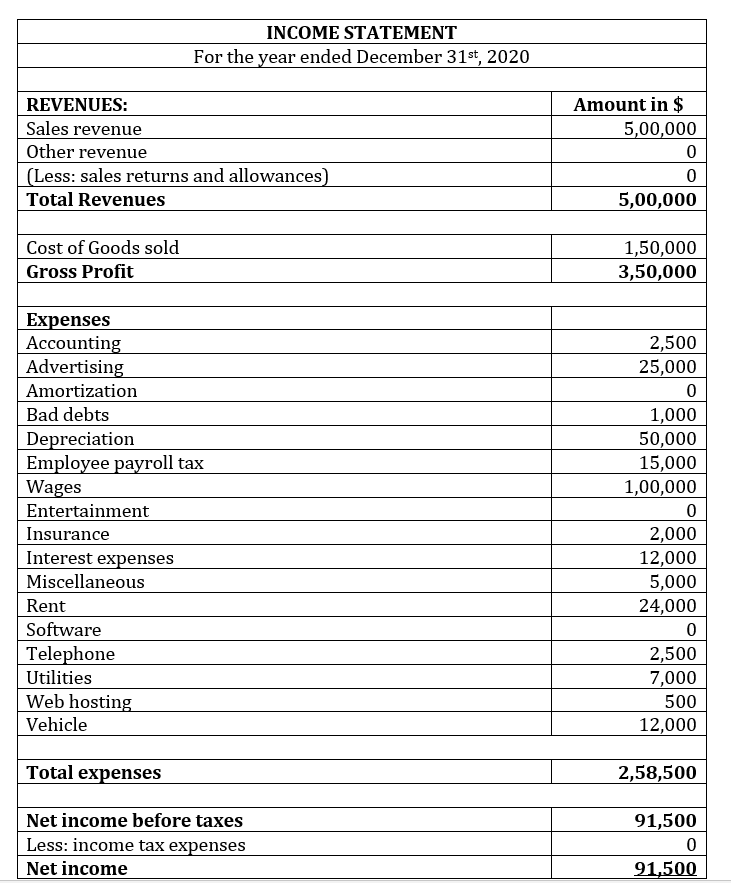

Let us consider the format and example of Income statement:

So, this was a sample of how the income statement format looks like.

Financial Metrics found from the Income statement?

A financial statement is a powerful tool to know about the financial health of the business. Similarly, income statement shows various financial metrics that includes various formulae, which are as follows:

Gross Margin= Gross Profit/ Revenue

The gross margin ratio shows the percentage of sales revenue used either as a profit or reinvestment. It indicates that the pricing of the cost of goods sold may be too high or too low.

Profit Margin= Net income after tax/ Net sales

It shows the profit per sales dollar after all the expenses are deducted from sales. Profit margin is also used to identify to check or see if the operating expenses are too high or low.

Break even sales= Fixed costs/ Contribution margin

For calculating break-even sales, first we need to identify the fixed costs and variable costs. Fixed costs are the costs that will not change throughout the year such as rent, Internet, telephone bill. On the other hand, variable costs are the cost that will change as per the sales.

The other thing to calculate is contribution margin. It indicates how much profit is left over after deducting all the variable expenses to pay for fixed expenses.

Wrapping up

Now after understanding and knowing how to prepare the income statements, we will be understanding about the preparation of balance sheet in the next article.

Powered by Froala Editor