Introduction

In order to create accurate financial statements without any flaws and mistakes, one needs to create adjusting entries for your expense, revenue, and depreciation accounts.

Adjusting entries as the name suggests, are recorded at the end of an accounting period to properly record the income and expenses that are not yet recorded in the general ledger and should be properly made prior to the closing of the accounting period.

Overview: What are adjusting entries?

It is an important part of an accounting cycle and important part of accrual accounting. Adjusting entries allows you to adjust income and expense totals more accurately that will reflect in your financial position.

After the preparation of an initial trial balance, you can prepare and post the adjusting entries to make the accurate data and thus, the accurate financial statements.

Why are adjusting entries important?

If the adjusting entries are not made, the financial statements such as balance sheet, profit and loss statements, and cash flow statement will not be accurate. Here are some of the consequences of not recording adjusting entries:

- Revenue will appear too low.

- Expenses may be understated.

- Financial statements will not be accurate.

How to prepare adjusting entries?

Every adjusting entry recorded will not be the same. Some will have a slight difference. Let us look at some of the examples of how to record an adjusting entry:

Step 1: Recording accrued revenue

Any time you offered the service and you are not been able to invoice your customer, you have to record the entry as accrued revenue. For instance, John owns a clothing store. He bills his clients for the beginning of the following month.

His bill for the month of January is $2,000 but since he won’t be billing until February 1st, he will have to make an adjusting entry of accrued revenue earned of $2,000.

Once his client pays the bill on February, he will have to reverse the entry.

Step 2: Recording accrued expenses

If you are paying your employees’ wages or salaries bi-weekly then payroll is the most common expense that will need an adjusting entry. For instance, salary paid to the employee bi-weekly of $ 15,000. Any hours worked in the current month that will not be paid until the following month must be accrued as an expense.

The salary is paid in the 10TH of February. The reverse entry will be as follows:

Step 3: Recording deferred revenue

You will have to defer the revenue until it is earned if your business is receiving payments from clients in advance. For instance, if your business is offering security services and one of your customer paid $3,000 in advance of six months of services to be provided.

Since the revenue has not been yet earned it is to be deferred and the following is the Journal entry of recording initial payment:

For the next six months, you have to record $500 in revenue until the deferred revenue balance is zero.

Step 4: Recording prepaid expenses

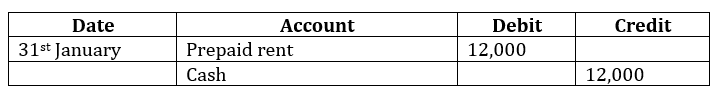

Prepaid expenses are just similar to deferred revenue. For instance, you have decided to pay the rent in advance for the whole year that is $ 12,000.

Since you do not want to place $ 12,000 total expense in the month of January, you need to place the prepaid rent account and expense it for each month for the next 12 months.

Here is the journal entry for initial payment of rent:

For the next 12 months, you will have to record $ 1000 in rent expenses and reduce your prepaid rent accordingly.

Step 5: Recording depreciation expenses

Depreciation is the wear and tear of the asset. Any time you purchase an asset one should be aware of the accumulated depreciation and depreciation expenses.

For instance, if you purchase $ 5,000 with a useful life of 5 years and a salvage value of $ 1,000, you can depreciate the asset for five years making you monthly depreciation to be $ 66.67 per month for five years.

Here is the journal entry for depreciation:

The journal entry is recurring until the depreciation expense balance is zero or until the asset is sold.

Adjusting entries are vital

Well, many of you might be thinking of what is the use of these adjusting entries? How can you convince a potential investor to invest in your business if your financial statements are inaccurate? In order to have an accurate picture of the financial health of your business, you need to post and make the adjusting entries.

As we all know that we are preparing and following the double entry bookkeeping system of accounting where every debit has equal and corresponding credit and vice versa. Thus, it is assumed that the sum of all debits is equal to the credits.

After recording the entries into Journal and posting it to the ledger books, the credit or debit balances are further recorded in the trial balance of the business.

Thus, trial balance is prepared to basically check if debit or credit amounts recorded are accurate or not.

Wrapping up

Adjusting entries are vital to provide an error free trial balance and trial balance is the first step of preparation of financial statements, which ultimately checks the accuracy of the final position of the books of accounts.

Powered by Froala Editor