Definition cash flow statement

Cash flow statement as the name suggests determines the cash inflow and cash outflow of your business. It explains the cash flows by three activities: operating, investing, and financing activities.

Cash flow statements resembles a check book of your business with a few other items that affect the cash inflows and outflows.

Cash flow statements are equally important as income statements and balance sheet. It is prepared by most of the businesses unless it is a very small business.

However, in this article we will be understanding a sample example and learn to prepare the general cash flow statement format. One can also find the cash flow statement template online.

Sections in the cash flow statements:

The cash flow statements are divided into three activities:

#1 Cash flow from operating activities:

Cash flows from operating activities are the summary of cash receipts and payments and also a change in cash flows from daily operations. It also includes interest paid and received, dividend received, and cash received from customers and cash paid to suppliers, personnel, etc.

Cash flow from operating activities include:

- Cash received from sale of goods and services

- Payroll payments to employees

- Payment to suppliers and contractors

- Rent payments

- Utility payments

- Tax payments

#2 Cash flow from investing activities:

Cash flows from investing activities have the summary of acquisition and sale of fixed assets and investment along with the changes in cash because of investments and disinvestments. It also includes long-term financial assets.

Cash flow from investing activities include:

- Purchase of fixed assets

- Sales of fixed assets

- Purchase of inventory or any other cash equivalents

- Proceeds from the sale or redemption of investments

#3 Cash flows from financing activities:

Cash flows from financing activities have the transactions related to equity financing and borrowings. It provides a change in cash as a result of obtaining and repayment of loans, buyback of shares, and paying dividend.

Cash flow from financing activities include:

- Repayment of debts

- Instalments of loans

- Proceeds from loans, or new borrowings

- Cash received from issuance of inventory or equity

- Dividend payments

- Purchases of treasury stock

- Returns of capital

Different methods in cash flow statement

The “cash flows from operating activities” is the most complex section as there are two methods for preparing this section.

- Direct method

- Indirect method

The above methods will yield the same result but the procedures are different.

#1 Direct Method:

Direct method includes the sources of operating cash flows and uses of operating cash flows such as cash received from customers, cash paid to suppliers, etc. However, this method is not popular among many small businesses as the data may not be readily available.

#2 Indirect Method:

Indirect method begins with the operating cash flows at the beginning with the net income from the profit and loss statement. After that, different adjustments are made to undo accrual accounting.

It is comparatively easier to prepare the cash flow statement through indirect method. A lot of loan officers are required to prepare the cash flow statement through direct method and hence, it requires the compilation of additional operating activities.

But it is clear that both these methods will have the same result at the end.

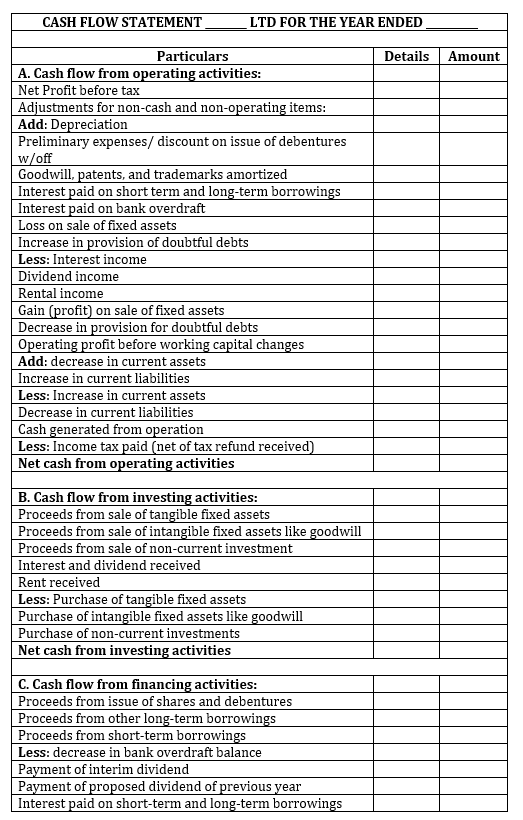

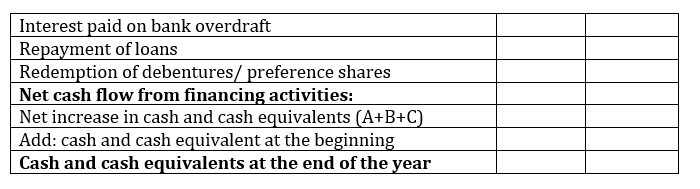

Format of cash flow statement (indirect method)

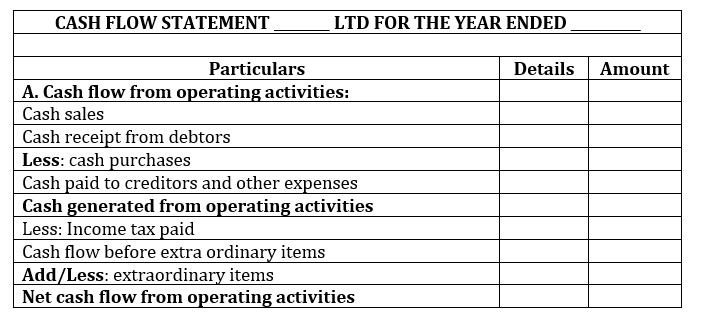

Cash flow statement format (direct method)

In the direct method, the cash flows from operating activities are to be prepared as under:

Key points

Let us look at some of the key points in preparing the cash flow statements:

- Cash flow statement is the summary of cash inflows and outflows.

- It includes three activities: operating, investing, financing

- There are two different methods to prepare cash flows from operating activities.

- Direct method starts with showing separate cash flows and indirect method starts with the net income followed by different adjustments

- Cash flows from investing activities include cash invested/ disinvested/ making adjustments.

- Cash flows from financing activities include cash raised/repaid by issuing or repaying loans and paying a dividend.

Powered by Froala Editor