What is Business Valuation?

Business valuation is a general process of determining the economic value of a company or its assets. It can be done into two ways, enterprise valuation or market (equity) valuation.

Why do we need Business Valuation?

There are four business valuation techniques which are used by Investment Bankers. But why do we value a business or a firm? The answer is simple, because the valuation techniques tell us about the actual fair value of a business, and the current state of company so that we can take better investment decisions with compare to firm A to firm B of an industry.

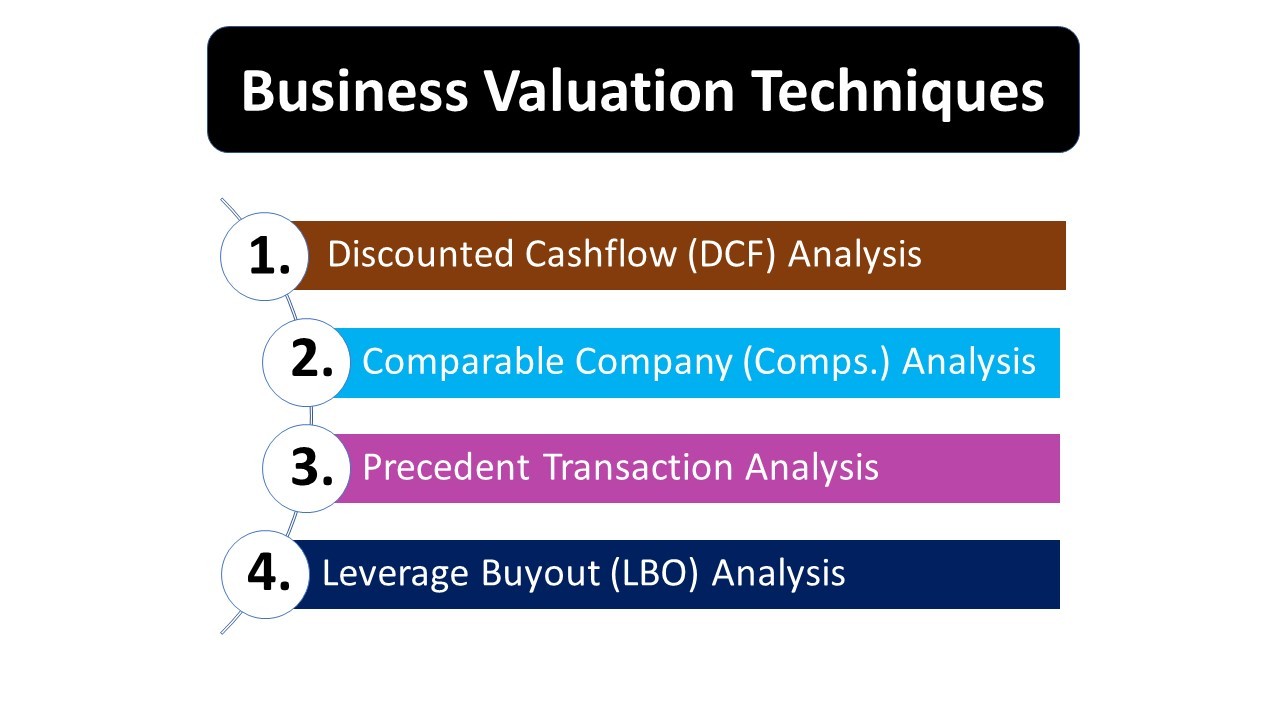

Business Valuation Techniques

Business Valuation Techniques

Business Valuation Techniques

1. Discounted Cash Flow (DCF) Analysis

1. DCF analysis values a business by project its future Free Cash Flow (FCF) and then using the Net Present Value (NPV) method to value a firm.

2. DCF valuation builds off of Free Cash Flow forecasts that are typically done for the upcoming 5-10 years.

3. DCF valuation primarily returns the Enterprise Value of a company, because FCF refers to the cash generated by the operations of a business, irrespective of net debt or minority interest/preferred equity. However, a DCF model can also be used to project Market Value if interest expense and minority interests are projected and stripped out to produce Levered Free Cash Flow (FCFF) DCF Valuation

DCF Valuation

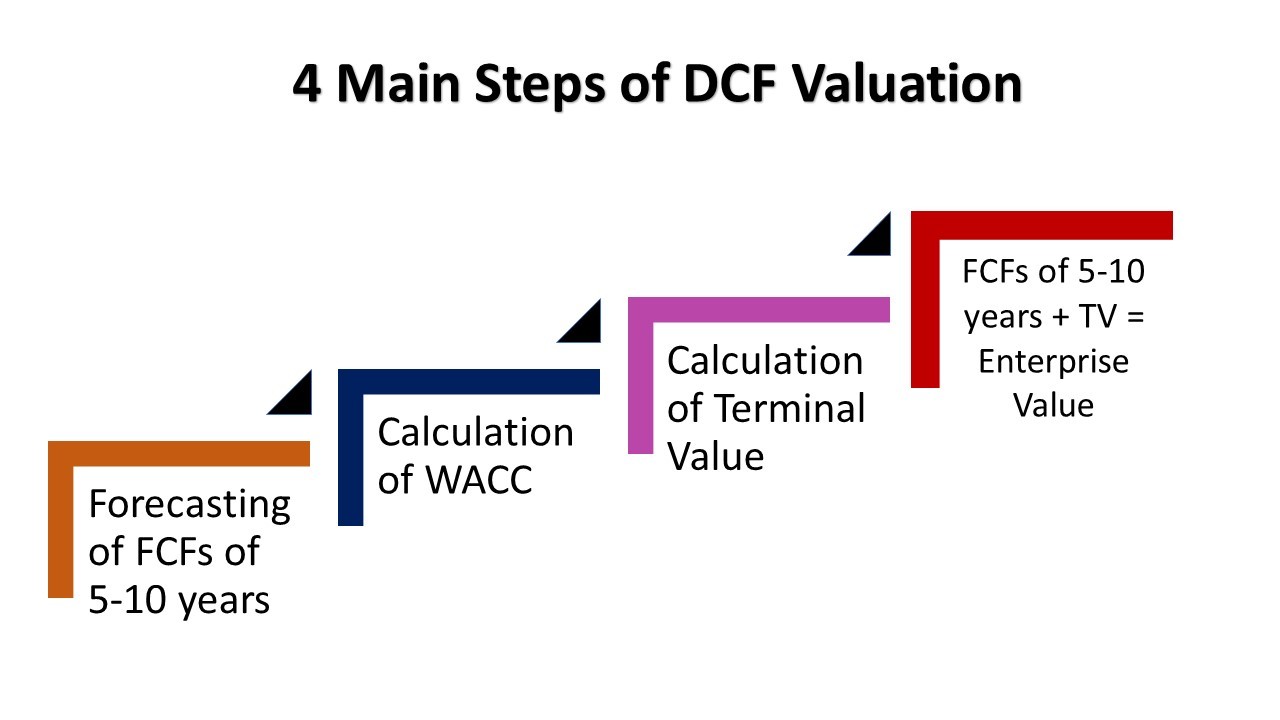

4 main steps of a DCF Valuation:

- Forecast out a company’s Free Cash Flows for 5-10 years.

- Calculate the Weighted Average Cost of Capital (WACC).

- Calculate firm’s Terminal Value, or the future value of the firm assuming a long stable growth rate.

- Summation of discounted 5-10 years forecasted FCF and Terminal Value back to O(today) of the firm to derive the company’s Enterprise Value.

2. Comparable Company Analysis

Comparable Company Analysis (CCA) can also be referred as “Comps”, is a relative valuation technique, unlike DCF analysis which derives an intrinsic value of a firm. While, Comps used to find company values based on trading multiples (Enterprise Valuation (EV) multiples such as EV/Sales, EV/EBITDA and EV/EBIT or Market Valuation multiples such as P/E, P/B and P/Sales) or ratios of similar public companies.

Comps Valuation

Comps Valuation

3 main steps of Comps:

- Identification of similar publicly traded companies (having similar characteristics) to the company being valued.

- Calculation of trading multiples (EV/EBITDA, EV/Sales and PE ratio) of all companies.

- Assign these multiples to the company financial results to determine valuation ranges.

3. Precedent Transaction Analysis (PTA)

Precedent Transaction Analysis (PTA) can be referred as “Comparable Transactions”, looks at recent M&A (Mergers & Acquisition) activity involving similar companies to get a range of valuation multiples. This transaction valuation analysis relies on whatever historical M&A transaction information is available. PTA can be done in both of the ways (Enterprise Valuation and Market Valuation). For example, EV/Sales or EV/EBITDA multiple refer to enterprise value, while Price/Earnings (Market Capitalization/Total Income) multiples would refer to market value.

Precedent Transaction Analysis (PTA)

Precedent Transaction Analysis (PTA)

4 steps of Precedent Transaction Analysis (PTA):

- Identifying publicly traded companies with similar characteristics.

- Calculation of enterprise and market trading multiples (EV/EBITDA, EV/SALES and PE ratio).

- Assigning multiples to company’s financial results to determine valuation ranges.

- Calculation of premium over market value.

4. Leverage Buyout (LBO) Analysis

Leverage Buyout Analysis or LBO is the acquisition of a private or public with the significant amount of borrowed funds. This valuation analysis technique is majorly used in private equity firms. This happens when a Private equity firm sponsors any firm. This is a transaction valuation-based technique, because private equity buyers typically look to sell firm within 5-10 years after purchase. LBO mostly revolves around firm’s Enterprise Value, because the entire business will be acquired and all (or essentially all) of the pre-existed Debt will be paid off. 5 main steps of Leveraged Buyout (LBO)

5 main steps of Leveraged Buyout (LBO)

5 main steps of Leveraged Buyout (LBO):

1. Make transaction assumptions based on the purchase price, Debt interest rate etc.

2. Build the sources & uses of capital, where the sources refer how transaction will be financed, and uses lists the Capital uses.

3. Balance Sheet adjustments for the new Debt and the. Equity and other related-transactions.

4. Project out the three financial statements (usually 5 years), and determine how much Debt is paid down each year.

5. Calculation of exit value scenarios based on EBITDA multiples.

Powered by Froala Editor