Introduction

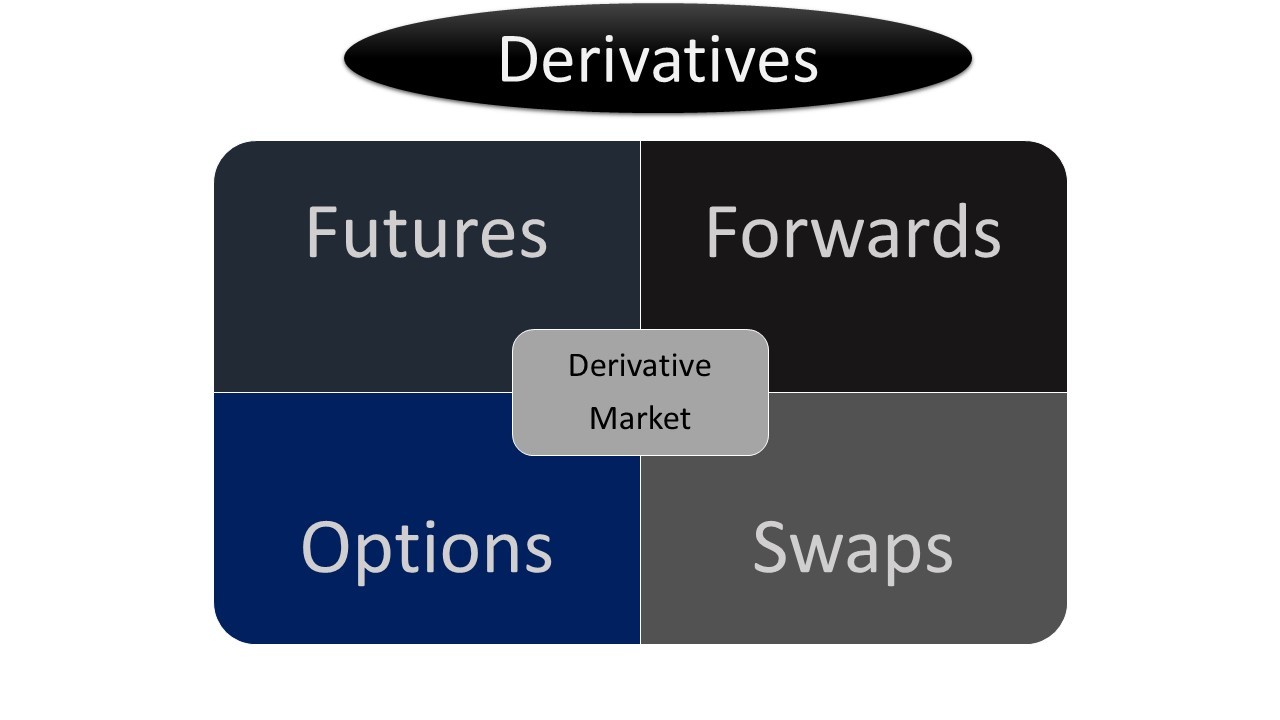

The derivative market can be classified as a financial market for various derivatives, derivatives are financial instruments like future or forward contracts, options and swaps. A derivative’s value is derived from underlying financial assets or group of assets (market indices like S&P 500, SENSEX, NIFTY50), where underlying financial assets are stocks, market indices, bonds, currencies and market indices. It is known as deferred delivery or deferred payment instruments. (short and long position).

Market Participants

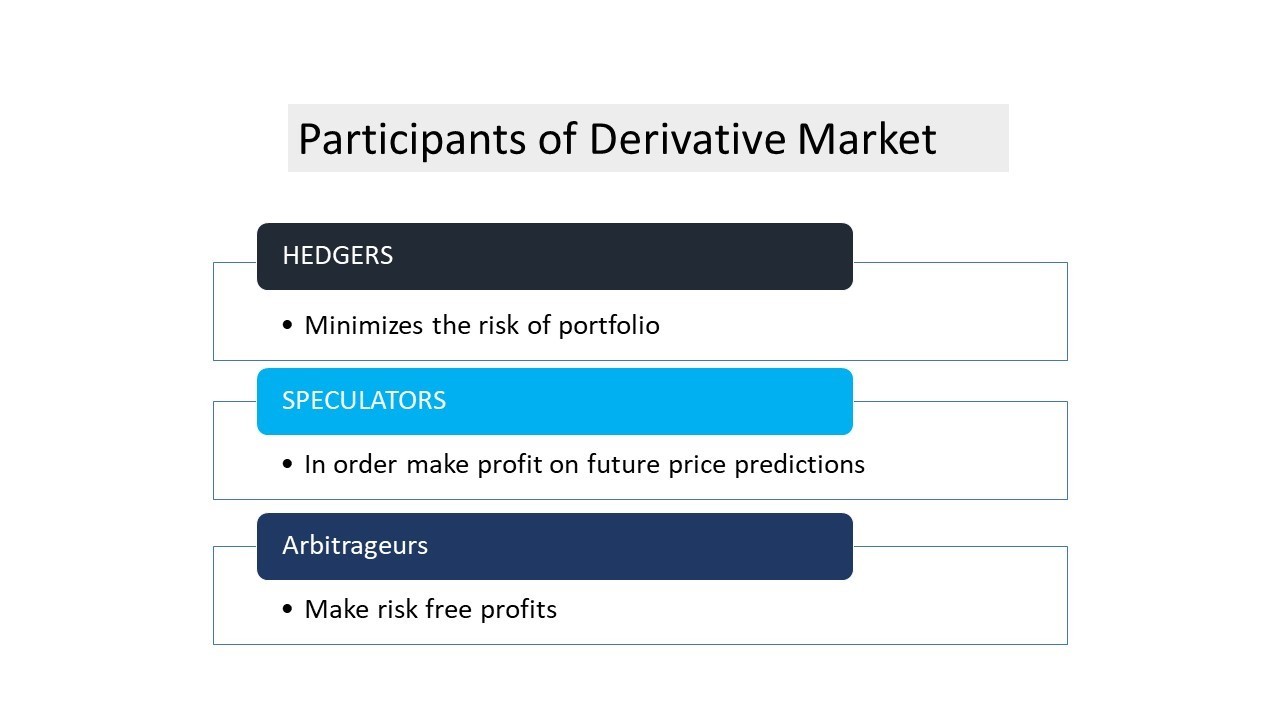

There are mainly three participants within the derivative market

Participants of Derivative Market

Participants of Derivative Market

- Hedgers – those people who buy or sell in the market to reduce the risk of their portfolios. These kinds of participants do not expect higher return within short time intervals. Instead, they just want to transfer some parts of risks through buying derivatives.

- Speculators – those people who enter into the market to make profit through selling or buying the derivatives in the market. These people just speculate to earn the profit and transacts the futures and options contracts. They have great gains as well as losses though predicting future market prices.

- Arbitrageurs – these people try to make risk free profits though calculated trading in various underlying assets. These people make money without losing any money, they use the price differences of same securities within different markets.

Market Structure

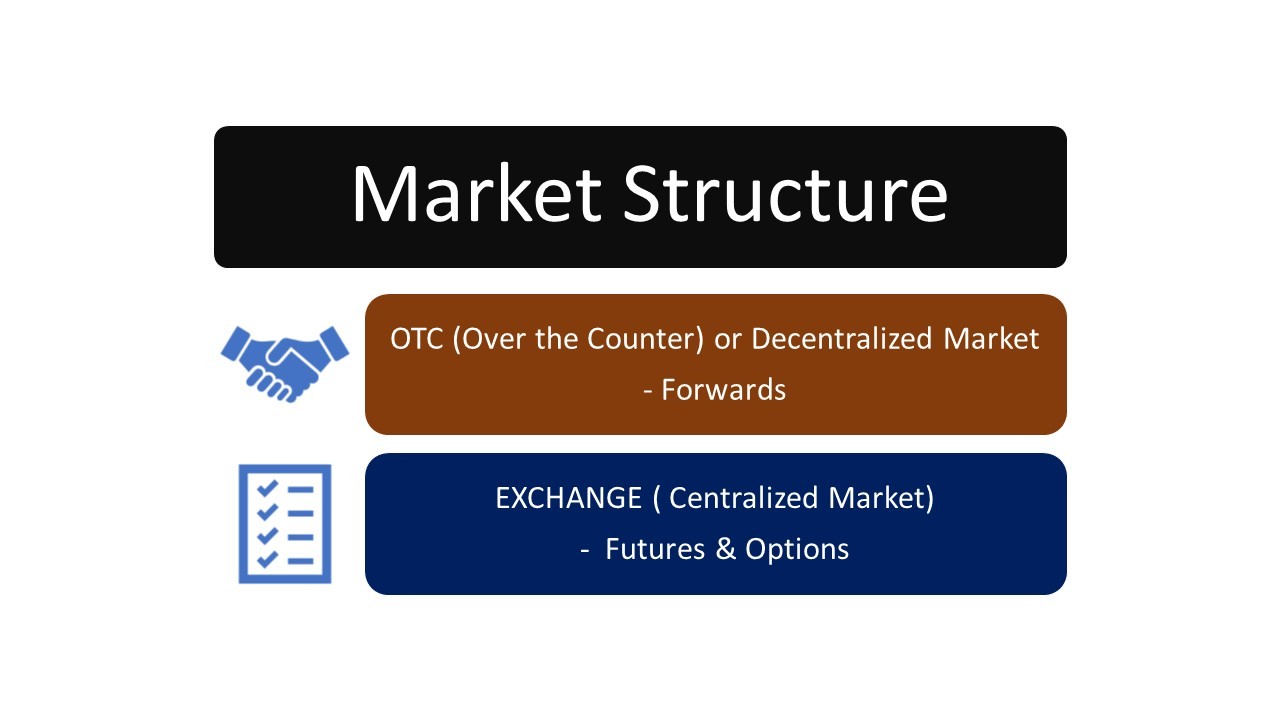

There are two types of market on the basis of transaction mechanisms

- OTC (Over the Counter) – The market where transactions take place between two parties directly or without any broker or any other third party, known as Over the Counter or OTC market. It is also known as decentralized market because there is no central authority who takes responsibility to have transparency and authenticity. These kinds of deals are done on the basis of trusts without involving any third party. Example - Forwards

- Exchange Market – The market where transactions take place between two or more parties indirectly or broker or any third party, known as exchange market. It is also known as centralized market. There is no doubt that people can trade or do deals of derivative contracts without involving any third party. But sometimes it becomes too risky to do such deals if both of the parties do not know each-other or we can say that there may be some possibilities of cheating or fraudulent activities. Examples – Futures & Options

Types of Derivatives

There are four types of Derivatives

Forward Contracts

It is the simplest or easiest form of derivative in which two parties go for an agreement to buy or sell an underlying asset at a predetermined future date and at a fixed-price. Usually, these contracts trade in OTC (Over the Counter) markets. There are mainly four types of forward contracts:

- Closed Outright Forward: These are the most common types of forward contracts; it is also known as European contracts or standard-forward-contracts. Within this type of forward, both of the counter-parties do an agreement to exchange funds or securities on a specified date and at a specific price within future.

- Flexible Forward: Within a flexible forward contract, both of the counter-parties do an agreement to exchange their funds on or before the settlement date at a fixed price within future.

- Long-dated Forward: Long-dated forward contracts seem almost similar with other forward contracts but these types of contracts make themselves different through their maturity dates or intervals and which is more than one year.

- Non-deliverable Forward: Instead of trading financial assets digitally, when the counter-parties do forward contracts within the physical forms of assets such commodities, currencies or any other asset. However, in this case parties can do only non-deliverable forward contracts, and that is why they only exchange the difference between spot rate and contract rate.

Future Contracts

It is a legal derivative contract in which two parties enable to buy or sell an asset at a predetermined future date and a fixed price through an exchange market or a third party. These contracts trade on exchanges.

Future contracts can be classified into several types but some of them are:

- Stock Futures: It happens when someone do future contract agreements with the broker through stock markets in which stocks trades on stock markets. And if any participant involve himself within this agreement, he or she also gets advantage via leverages. For example: if A wants to do a future contract to XYZ exchange then he will only have to pay around some percentage of total amount. N ow let's assume that he wants to do a future contract of 800k USD and the initial margin is 10% then he will have to pay only 80 k USD.

- Index Future: Index future contracts can be done when someone want to do speculation on market indices like S&P 500 or SENSEX or NIFTY-50 (in India).

- Commodity Future: Commodity future contracts are done when any participant tries to do speculation on commodity prices.

- Currency Future: Currency future contracts are the contracts or the agreements between the counter-parties which are done via a centralized authority. In which both of the counter-parties decide to exchange their securities at a predetermined fixed price and a settlement date within future.

- Interest-rate Future: Interest-rate future contracts are the type of future contracts or agreements, which can be done in case of fixed-income securities such as bonds and money-market securities.

Options – These are the financial instruments which are derivatives of various underlying assets like stocks. These contracts give rights or opportunities to the trader, to buy or sell the underlying asset by a certain date and at a specified price (strike price). Options are of two types: calls and put

- Call Option: A call option gives a right to buyer, but not an obligation, to buy the underlying financial security at a specified strike price as per the basis of option contract. This happens when a speculator or investor or security holder expect some rise within a security's price

- Put Option: A put option gives a right to buyer, but not an obligation, to sell the underlying financial security at a specified strike price as per the basis of option contract. This happens when a speculator expects some decrease within the security's prices.

Swaps- A derivative contract though two counterparties exchange the cash flows or liabilities though various financial instruments.

Powered by Froala Editor