Capital Budgeting Techniques:

Capital budgeting is a technique that is used by the company to analyze the investments or projects to be made, expenses to be incurred and maximizing the profits with the help of considering different factors such as funds availability, project’s economic value, taxation, capital return, and accounting methods.

Popular Capital Budgeting Techniques (With Examples):

- Profitability index

- Payback Period

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Modified rate of return

Now let us dive in to the details of the above techniques:

#1. Profitability Index:

Profitability index indicates the relationship between the payoff and investment of the project. It is the ratio that indicates the present value of future cash inflows discounted at the rate of return required to the cash outflow at the stage of investment.

Formula:

Profitability index= PV of cash inflows/ Initial Investment

Where PV= Present Value

PV of cash inflows is lower than the initial cost of investment if the profitability index is lower than 1.0. Alternatively, profitability index greater than 1.0 indicates a worthy project and it is acceptable. The method is commonly used for ranking projects.

#2. Payback Period:

It refers to the period where enough cash is generated by a proposed project so that the initial investment is recovered. Shorter payback period is suitable for project.

This method is used to find the profitable project. The main disadvantage of this method is that it ignores the time value of money. Generally, an opportunity cost is included if we payback to an investor tomorrow. But payback period method does not include time value of money.

Formula:

Payback Period= Initial cash investment/ Annual Cash Inflow

Example:

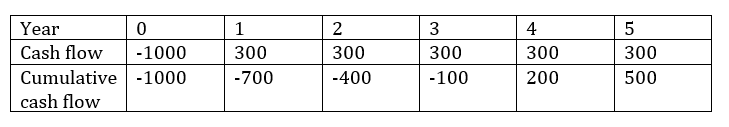

If there is an initial investment of $ 1,000 and the cash flow generate is $ 300 for the next five years.

Thus, the payback period is calculated as follows:

- Payback period= no. Of years- (cumulative cash flow/ cash flow)

- Payback period= 5- (500/300)

- Payback period= 3.33 years

- 3.33 years will take for an investment to recover.

#3. Net Present Value (NPV)

Net Present Value (NPV) is the difference between present value of incoming cash flow and the outgoing cash flows for a particular period of time. It analyses the profitability of the project. NPV method is used to evaluate capital investment proposals and compared with the initial investment. If the PV of cash inflows is more that the cash outflow, the project is accepted.

The greatest advantage of this method is that it considers the time value of money and helps the owners to achieve maximum profits. It also considers the cash flows during product tenure and risks associated with cash flows and cost of capital.

Formula:

Net Present Value (NPV)= Present value (PV) of cash inflows – Present Value (PV) of cash outflows

NPV = [Cash Flow / (1+i) n] – Initial Investment

Where i= discount rate

N= number of years

If there are two positive NPV projects, select the one, which has higher positive NPV.

Example:

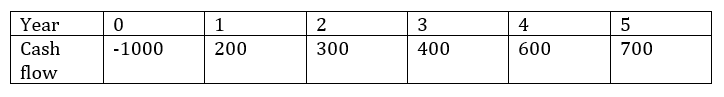

Let’s assume a given example where discount rate is 10% and number of years is 5 years.

Thus, the NPV is calculated as follows:

- NPV= (Discount rate, cash flow from 1st: cash flow till 5th year) + (-Initial investment)

- NPV= (10%, 200:700) – 1000

- = 574.731

- The above calculation can be done through an inbuilt formula in excel

#4. Internal Rate of Return (IRR)

Internal rate of return is the most profitable method to determine whether the investment to be taken or not. Here NPV is taken to be zero. At this stage, the PV of cash inflows is equal to the cash outflows. It also considers the time value of money. If IRR is more than WACC (Weighted average cost of capital), the project is acceptable. In case of more projects, IRR with highest percentage is selected.

Formula:

NPV = [Cash Flow / (1+i) n] – Initial Investment =0

Where i= discount rate

N= Number of years

Here we need to find the “i" that is discounting rate.

Example:

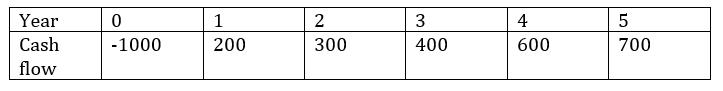

Let us understand the IRR in a better way with the help of the following example.

We need to find the discounting rate where NPV is taken as zero. Let us assume the discount rate to be 10%.

Thus, IRR is calculated as follows:

- IRR (cash flow from 0 to 5th year)

- IRR = 26%

- The above calculation is done with the help of using pre-built formula in excel

Conclusion:

Capital budgeting is a process of decision making related to the acceptance or rejection of long-term investments and projects. The above four techniques of capital budgeting are the most popular and effective methods for decision-making. We have seen different formulas for calculating the capital budgeting techniques. In the next blog, we will be learning each method in detail.

Powered by Froala Editor