Introduction

DCF or Discounted Cash Flow Method is a valuation method used to estimate the value of an investment done by the company based on the future expected cash flows. DCF Method strictly uses the TVM Concept (Time Value Money Measurement) while attempting to figure out the value of current investments. It then uses NPV Method (Net Present Value Concept) to project future cash flows of the firm.

The method is basically important for all the investors who are about to take a decision regarding acquiring a company, investing in a start-up, or buying a stock. It is also important for the business owners and top-level managers who want to take capital budgeting decisions such as opening a new factory, or purchasing new office equipment.

DCF Basics: The Present Value Formula:

The DCF approach is to forecast the company’s future cash flows and discount them to arrive at the present value of the company. The present value indicates the amount investors are willing to pay.

If we make the same proposition but instead of promising Rs. 1000 for 1 year if we promise it for the next five years. The formula gets little complicated:

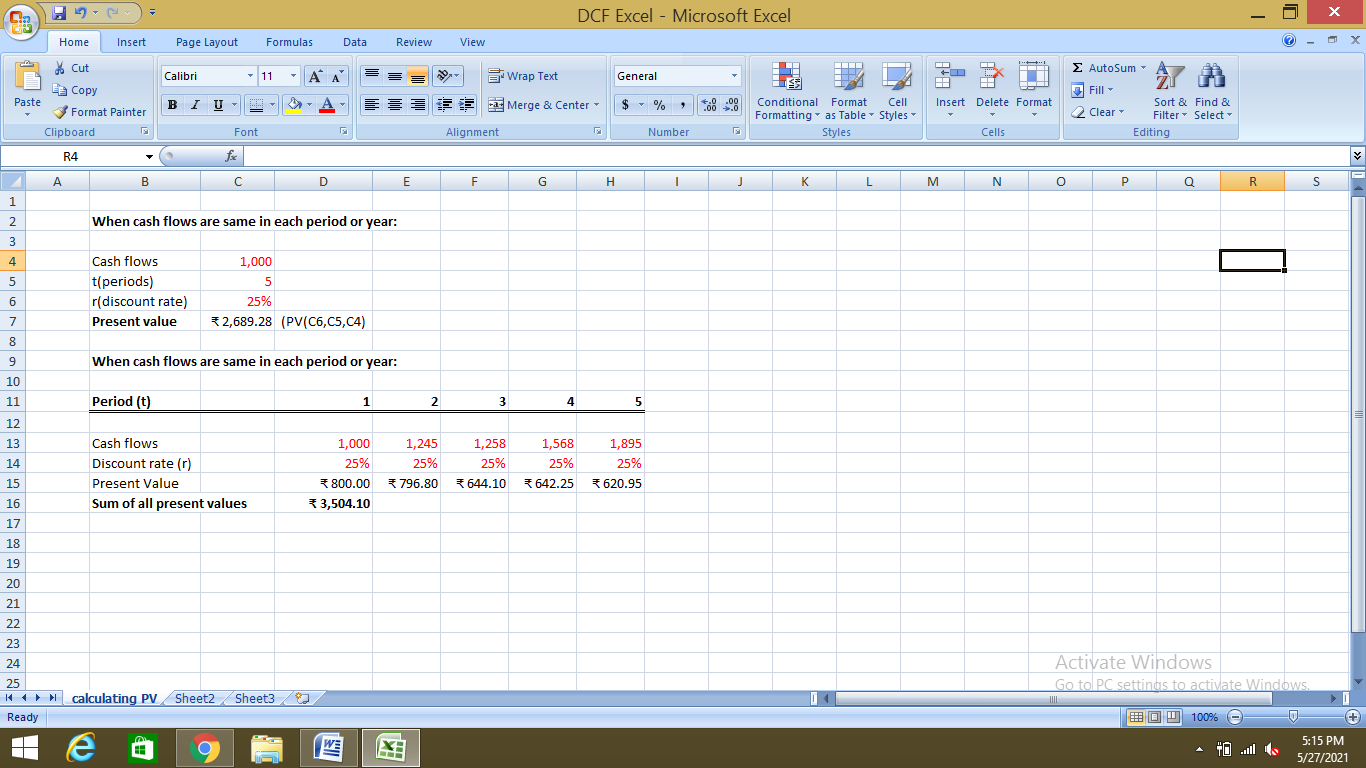

In Excel we can calculate the DCF using the PV Function. However, you need to understand that if the cash flows are different, you will have to discount each cash flow separately.

6 steps in building a DCF

The first step is to define and calculate the cash flows that the business generates which has mainly two approaches:

Forecasting unlevered free cash flows:

The cash flows the company generates from its core operations after completing the entire accounting process for operating expenses and investments. It is called unlevered cash flows.

Calculating the terminal value:

One cannot keep on forecasting cash flows forever. Thus, one needs to make higher assumptions about cash flows by estimating a lump-sum value of the business. It is known as “terminal value”.

Discounting the cash flows through WACC (Weighted Average cost of capital):

WACC reflects the riskiness of the unlevered free cash flows that represents all operating cash flows belongs to the company’s lenders and owners. After discounting, the present value of all unlevered cash flows is called the “enterprise value”.

Add non-operating asset value to the present value of unlevered free cash flows:

Any cash or investment sitting on the company’s balance sheet must be added to the unlevered FCF’s. For instance, if we calculate PV of Samsung’s unlevered FCF is $700 billion but later if we discover $200 billion in cash, we need to add this as well.

Subtract debt and non-equity plans:

The ultimate goal of the DCF is to get what belongs to the equity owners. Subtract it from the present value if the company has any lenders. What’s left over value belongs to the equity owners.

In our example, if the Samsung had $50 billion in debt obligations at the valuation date, the equity value calculated is:

$700 billion (enterprise value) + $200 billion (non-operating assets) - $50 (debt) = $850 billion.

Net debt represents the addition of non-operating assets and debt claims.

Enterprise value- net debt= Equity Value.

Divide the equity value by shares outstanding:

The total value to the owner is known as equity value.

Calculating the unlevered FCFs:

FCF= EBIT (1-TAX RATE) + D&A + NWC – Capital expenditures.

EBIT: Earnings before interest and taxes.

Tax rate: The tax rate the company is expected to pay.

D&A: Depreciation and amortization.

NWC: Annual changes in working capital.

Capital expenditures: represents cash investments

Three key assumptions in the DCF Model

After completing the 6 steps the key assumptions that led us to the value, we arrived at are:

1. The operating assumption

2. WACC

3. Terminal value assumption.

Each of these assumptions is critical to get an accurate model.

Pros and cons of DCF Model

Conclusion:

DCF Model is one of the common models used by investment bankers and other finance professionals. DCF Model always presents the range of terminal value and WACC Assumptions.

Powered by Froala Editor